FinTech: Shaping The Financial World and Here’s Why You Should Know It

It’s a multi-billion dollar industry that’s changing everything from how we make purchases to how we get loans.

It’s a multi-billion dollar industry that’s changing everything from how we make purchases to how we get loans.

What is FinTech?

If you’ve ever paid for something with your phone, transferred money using an app, or checked your bank statement online, then you’re already part of this multi-billion dollar industry.

It’s called Fintech and it’s changing economies around the world. It is short for “Financial Technology”. It includes a huge range of products, technologies, and business models that are changing the financial services industry. It refers to everything from cashless payments to crowdfunding platforms, to robo-advisors, to virtual currencies. Some of the world’s biggest companies from Apple to Alibaba are going big on it, too. Just think of Apple Pay and Alipay.

For many of the companies and consumers, FinTech is more than a buzzword. It’s a big business opportunity.

How It Works

Financial technology has filled a void for people around the world who don’t have access to traditional banking services. In fact, it’s estimated nearly two billion people worldwide are without bank accounts. Now, thanks to FinTech, all you need is your phone to take out a loan or insurance.

The rise of FinTech has forced traditional lenders, insurers, and asset managers to embrace new digital technologies. For example, wealth managers now have to compete with “robo-advisors” — which are automated financial planning services. I mean talk about rise of the robots, right?

Thanks to high-tech algorithms, these services are available 24/7 and can be more affordable than traditional asset managers.

Here’s a video I found on Youtube (disclaimer: not sponsored) that will be helpful for those who need details on how FinTech works:

Now, how do you build a fintech product that people would want to download? Let’s look at the process.

9 Steps of Fintech Application Development

Step 1: Conduct research.

Step 2: Select a tech stack.

Step 3: Gather a team.

Step 4: Define the minimum viable product.

Step 5: Think of APIs and integrations.

Step 6: Focus on security.

Step 7: Design the interface.

Step 8: Launch the beta version.

Step 9: Support the application.

Let’s discuss further my favorite part; Step 7 which tackles UI/UX design.

Why is Fintech user experience so important?

Ever wondered what makes a great financial product? Is it the number of functionalities and features it has? Or creating something simple, innovative that helps get the job done faster and yet is in sync with the latest design trends.

While innovations enriched with design trends and functionality are features that help financial services enhance their position and brand image, at its core, a product becomes special when you put the maximum focus on the USER.

Fintech UX Design is more about science — focusing on data, user behaviour, design patterns, and creating products that will solve customer’s pain points.

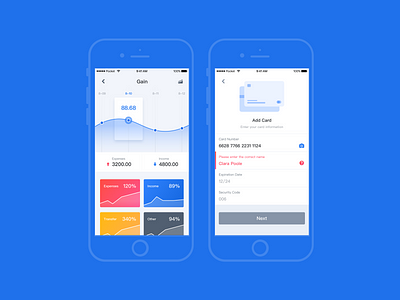

Some FinTech UI prototype designs from Epicpxls that you can download and edit straight away to help you start your design process instantly:

Download:

Download:

4. Meela — Money Transfer, Bank, Finance & Wallet App UI Kit

Download:

5. Mobi Wallet — Fintech Apps and Banking Mobile UI KIT

Download:

6. Bankdash

Download:

Download:

It doesn’t matter how advanced a financial product is or how creative the design interface is, the primary element will be still missing if it isn’t created by keeping the human psychology in mind.

The Future of FinTech

Fintech is only 1% finished. But what do we mean by that?

Investors are buying it. Many fintech companies have been partnering with traditional insurance companies to disrupt the traditional insurance model. Today, new financial technologies are penetrating the manufacturing sector (including retail, telecommunications, pharmaceuticals, agriculture); exert their influence on the segment of insurance, lending, accounting services, the mass appraisal of real estate, asset management, investment, tax administration, etc.

Fintech appears to be the natural evolution of certain financial services including banking. It is already developing what banks are only planning to experiment with. Most likely, some innovations will take root, others will not: this is facilitated by the competition between new financial enterprises.

In an increasingly digital world, trust will remain at the core of banking. That said, liquidity transformation will still have an important role to play. The nature of banking and financial services, however, will change dramatically.

The future of the financial services industry will solely rely on technology and its advancements.

Welcome to the new era of the finance industry.

Visit Epicpxls and select from up to hundreds and thousands of choices for your project. Be updated:

Facebook • Twitter • Instagram • Weekly Newsletter

What do you think about this article?

Don’t forget to 👏👏👏 if you enjoyed reading this story 💁♂️

and feel free to drop your thoughts down there in the comment section.